New York, NY (TopGun Press)

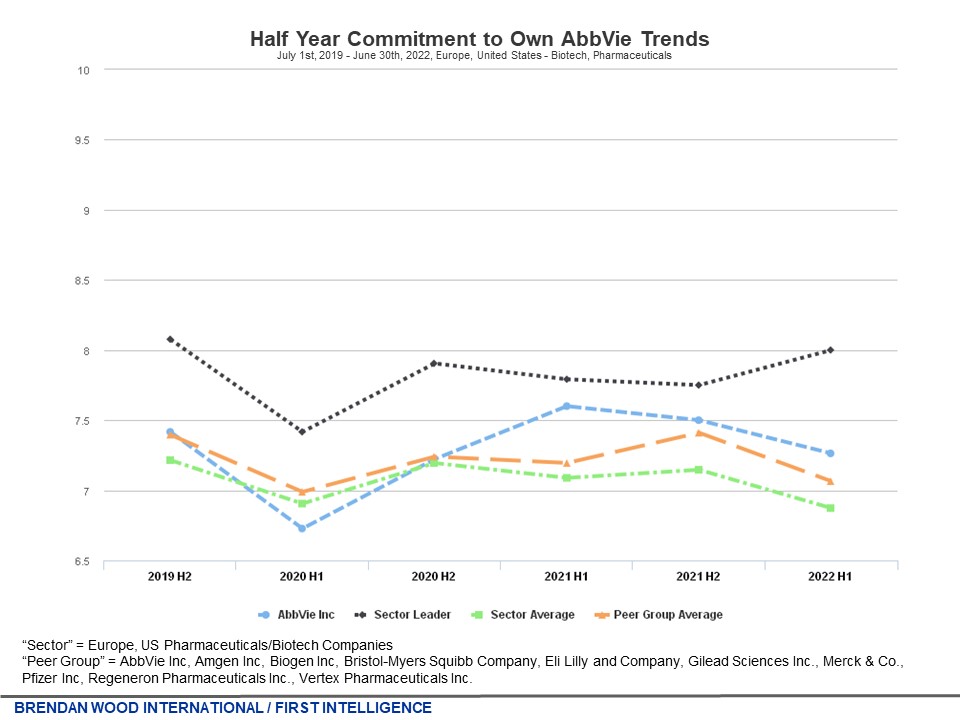

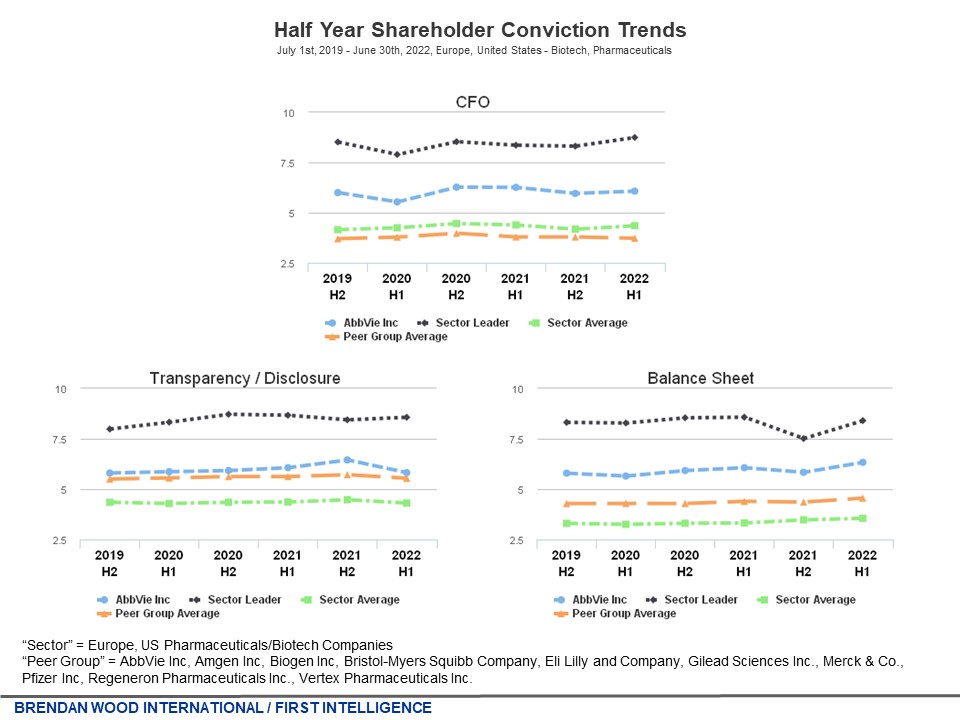

Given AbbVie’s announcement that Richard A. Gonzalez will retire as CEO to become Executive Chairman and that Robert A. Michael has been selected to succeed Gonzalez as CEO effective July 1, 2024, we’re providing the historical Half Year Commitment to Own AbbVie Trends and Shareholder Conviction Trends on AbbVie’s CFO, Transparency & Disclosure and Balance Sheet during Mr. Michael’s tenure as CFO, along with the relevant verbatim commentary on the like.

Typical Verbatim Commentary on AbbVie’s CFO, Reporting & Disclosure and Balance Sheet:

(July 1st, 2019 through June 30th, 2022)

“I think that AbbVie’s CFO, Rob Michael, is usually pretty good and he usually guides into a lot of detail, more detail than others. He needs to really have a good handle of the business to guide that way.”

“AbbVie’s CFO, Rob Michael, is probably my favorite right now because they always forecast pretty well.”

“AbbVie’s communication around numbers is very, very good. They don’t miss. I think they’ve been super clear about free cash flow and the way that they are going to reign in the net debt. I think they’ve executed on that and realizations on synergy. So, I have high confidence in their CFO.”

“AbbVie’s CFO, Robert Michael, is okay. One thing that’s good is that they usually guide well.”

“AbbVie usually guides pretty well. AbbVie is better than Eli Lilly and Pfizer in their reporting.”

“AbbVie gives product level guidance for the entire year, and they guide one quarter ahead. They’re quite differentiated in that sense. They tend to deliver on those short-term metrics.”

“AbbVie has done a good job with their very large acquisition. I have confidence in their balance sheet.”

“AbbVie’s payout ratio is enormous, so people have confidence in the balance sheet.”

“AbbVie’s CFO is newer. There is just a lack of history.”

“AbbVie’s CFO is newer to the role so there is a little less history there.”

“AbbVie’s prior CFO used to be considered very highly, but the one they have now is new.”

“AbbVie’s management is the CFO, head of commercial and then the head of R&D. This is the trifecta of the next generation that have been really the public face of the company at a lot of the investor conferences.”

“The AbbVie CFO hardly gets to say anything because the CEO just takes over. You don’t hear from the CFO. He’s just in the background because he’s not allowed to be visible.”

“AbbVie has got some headwinds coming its way and unfortunately the CFO won’t be able to prove that he’s been doing a good job.”

“I have never met the AbbVie CFO, but he only talks when Rick tells him to talk.”

“From an investor perspective, we don’t get as much access to AbbVie’s senior management team. It is basically the CEO, CFO and the President that are on all the calls and interactions with investors.”

“I don’t have confidence in AbbVie’s CFO because he hasn’t been there very long and hasn’t done anything yet. You listen to the conference calls and he doesn’t say anything; it’s the ‘Rick Gonzalez Show’.”

“I would prefer if AbbVie’s CFO, Rob Michael, answered questions with more strategic foresight. He usually defers to Rick Gonzalez most of the time.”

“I’m not as impressed by AbbVie’s CFO, Rob Michael. That’s more of a topline story than a bottom line story.”

“I don’t have confidence in AbbVie’s reporting and disclosure. AbbVie did two big investor events last year, an R&D update in March and an immunology day in December, and basically gave investors and analysts two weeks notice. The content’s good when they do the events, but you feel like they’re kind of on the back foot a bit.”

“I don’t think AbbVie’s balance sheet is strong, they are paying out an unsustainable dividend, and they have geared up the balance sheet for Allergan.”

“I have more confidence in Bristol’s balance sheet than AbbVie’s. It’s going to take AbbVie a lot longer to get back to net cash after the major transactions they’ve both done.”

“AbbVie has a lot of debt to pay.”

CLICK HERE for the Current Shareholder Conviction Trends on AbbVie

If you would like to subscribe to the BWI Shareholder Confidence Intel including full reports on individual companies with verbatim please send an email to aknott@brendanwood.com or jnovak@brendanwood.com

Click Here for the Brendan Wood International Investor Conviction Intel – Healthcare – January 2024

Click Here for the Brendan Wood International Investor Conviction Intel – Healthcare – November 2023

Click Here for the Brendan Wood International Investor Conviction Intel – Healthcare – September 2023

Brendan Wood International (BWI) serves a dual clientele of world leading investors and their corporate investment targets as well as broker dealers who provide research, sales and trading services to the investment community. Big cap companies looking for comprehensive investor confidence data on their organizations are likely to discover that Brendan Wood partners consult with their investors non stop year round. Investors depend on BWI to quantify the demand side of the investment industry across 1400 names worldwide, including the name by name research sales and trading professionals who influence investor demand.

About Brendan Wood International:

Brendan Wood International (BWI), formed in 1970, is a private advisory group which originates performance investigation programs in the capital markets. Brendan Wood Partners debrief large institutional investors worldwide on a daily basis. There are 2000+ live consultations with professionals overseeing +/- $55 trillion invested in the +/- 1400 big cap companies on the BWI Index. Relying on its real time performance intelligence, BWI advises public companies, institutional and activist investors, investment banks and broker dealers on strategy, performance and recruitment of TopGun talent. The firm’s partners have formally presented at 1000+ C level strategy meetings and corporate off-sites in fifty cities. Brendan Wood founded the exclusive TopGun Club, a performance based institution.

Disclaimer:

We wish to emphasize that all reports, evaluations and assessments contained herein, represent Brendan Wood International’s subjective judgment and opinions, based on our years of experience and on information obtained by us in the course of our research. Much of the factual information contained in the reports has been obtained by us from third parties on whose responses we have relied in good faith, independent verification by Brendan Wood International being, under the circumstances, impossible. While we believe that you will find our reports to be an invaluable tool in formulating your own strategies and judgments, the foregoing should be borne in mind. This report is not meant as investment advice and should not be interpreted as advising on the value of a company’s securities, the advisability of investing in, purchasing or selling any company’s securities or any other conclusion relating to investment/divestiture of a company’s securities. Finally, this report is not intended as an offer or solicitation for the purchase or sale of any company’s securities.

www.TopGunPress.com

www.brendanwood.com

@BrendanWoodIntl

Contacts:

Amanda Knott

Managing Director

Brendan Wood International

+1 416 924 8110

aknott@brendanwood.com

Jordan Novak

Partner

Brendan Wood International

+1 416 924 8110

jnovak@brendanwood.com

Posted in Press Releases

|

You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.