New York, NY, February 5th, 2024 (TopGun Press)

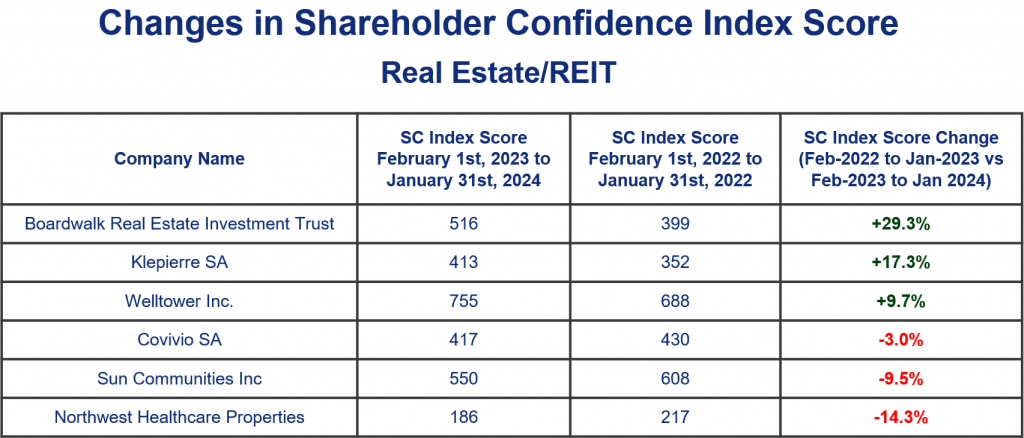

As the year unfolds, the 2023 and early 2024 data has revealed relevant findings. Below are some of the most respected and disenfranchised Real Estate/REIT stocks on the BWI Shareholder Confidence Index based on our daily chats with global investors.

Reflecting on the year-over-year changes up until the end of January, the BWI investor panel has provided clear insights on which regions, subsectors and names have garnered favour or disinterest among institutional investors.

Welltower in the US, Boardwalk in Canada and Klepierre in Europe:

According to institutional investors, these companies are at the top of the Real Estate/REIT Shareholder Confidence Index, signifying strong confidence, securing a favourable position and standing out as a preferred choice among them.

Sun Communities in the US, Northwest Healthcare Properties in Canada and Covivio in Europe:

Conversely, according to institutional investors, these companies are at the bottom of the Real Estate/REIT Shareholder Confidence Index, indicating investors’ lower level for 2024.

Digging deeper into the data and looking ahead to 2024, the following trends are anticipated to shape the Real Estate/REIT landscape:

US: With an average Shareholder Confidence Index Score of 590 points out of 1000, the US market exhibited stability and consistency, reflecting a similar investor confidence level compared to the previous year. However, beneath this overall stability, specific trends are evident when exploring the Real Estate/REIT subsectors. The following breakdown provides insights into where institutional investors focus has intensified or slowed-down towards the coming year:

- Investor confidence in Data Centres increased on average by 6.5%.

- Healthcare names increased their SC Index Score in only an average of 2.4% compared to last year were these companies averaged a score of 560.

- Surprisingly, Retail names SC Index Score increased on average by 1.5% compared to the year before.

- Storage names remain relatively flat in terms of investor confidence. These names saw a slight decrease of 1% in their SC Index Score.

- Interestingly, Residential names saw a decline of 1.4% in their SC Index Score compared to the year before. BWI universe of Residential names have the highest average score, an average of 671.

- The often maligned Office sector saw a decline of 4.6% on average in their SC Index Score compared to the year before.

Canada: With an average Shareholder Confidence Index Score of 462 points out of 1000, we’ve witness a modest investor confidence uptick if we compare it to the 456 points from the year before. Investors highlight the economic uncertainties and fears of higher for longer interest rates environment as their main reasons for their measured approach. Out of the 30 companies that BWI track in the Canadian Real Estate/REIT sector, only 11 companies saw an increase of more than 1% in their SC Index Score. Inversely, 10 companies saw a decrease of more than 1% in their SC Index Score during the last year and towards 2024.

Unsurprisingly, Canadian Office REITs took the biggest hit according to investors, on average these names saw a decline of 4.3% in their SC Index Scores. Economic shifts, remote work trends, and evolving office space dynamics have contributed to this decline.

On the other hand, Residential names saw the biggest increase for 2024. On average the Canadian Residential REITs SC Index Score increased by 5.8%.

Europe: With an average Shareholder Confidence Index Score of 464 points out of 1000, the region has gained some investor confidence if this is compared to the 444 points that the region scored on average the year before. By looking at the data, the two countries whose SC Index Scores increased the most were mainly France and UK, up 7.9% and 6.3% respectively. Germany on the other hand, saw a drop of 5.7% compared to the previous year.

Click here for the Investor Conviction Intel for Real Estate/REIT December 2023

If you would like to subscribe to the BWI Shareholder Confidence Intel including full reports on individual companies with verbatim please send an email to jnovak@brendanwood.com, gpelaez@brendanwood.com or gpeck@brendanwood.com

About Brendan Wood International:

Brendan Wood International (BWI), formed in 1970, is a private advisory group which originates performance investigation programs in the capital markets. Brendan Wood Partners debrief large institutional investors worldwide on a daily basis. There are 2000+ live consultations with professionals overseeing +/- $60 trillion invested in the +/- 1400 big cap companies on the BWI Index. Relying on its real time performance intelligence, BWI advises public companies, institutional and activist investors, investment banks and broker dealers on strategy, performance and recruitment of TopGun talent. The firm’s partners have formally presented at 1000+ C level strategy meetings and corporate off-sites in fifty cities. Brendan Wood founded the exclusive TopGun Club, a performance based institution. Brendan Wood International is the research provider and sub-advisor to the Brendan Wood TopGun ETF (Ticker: BWTG)

Disclaimer:

All reports, evaluations and assessments contained herein, represent Brendan Wood International’s subjective judgment and opinions, based on our years of experience and on information obtained by us in the course of our research. Much of the factual information contained in the reports has been obtained by us from third parties on whose responses we have relied in good faith, independent verification by Brendan Wood International being, under the circumstances, impossible. While we believe that you will find our reports to be an invaluable tool in formulating your own strategies and judgments, the foregoing should be borne in mind. This report is not meant as investment advice and should not be interpreted as advising on the value of a company’s securities, the advisability of investing in, purchasing or selling any company’s securities or any other conclusion relating to investment/divestiture of a company’s securities. Finally, this report is not intended as an offer or solicitation for the purchase or sale of any company’s securities.

www.brendanwoodtopgunetf.com

www.brendanwood.com

@brendanwoodIntl

www.TopGunPress.com

Contacts:

Jordan Novak

Managing Partner

Brendan Wood International

+1 416 924 8110

jnovak@brendanwood.com

Gerso Pelaez

Field Director – Real Estate/REIT, Pipelines, Utilities & Renewables

Brendan Wood International

+1 416 924 8110

gpelaezherrera@brendanwood.com

Posted in Press Releases

|

You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.