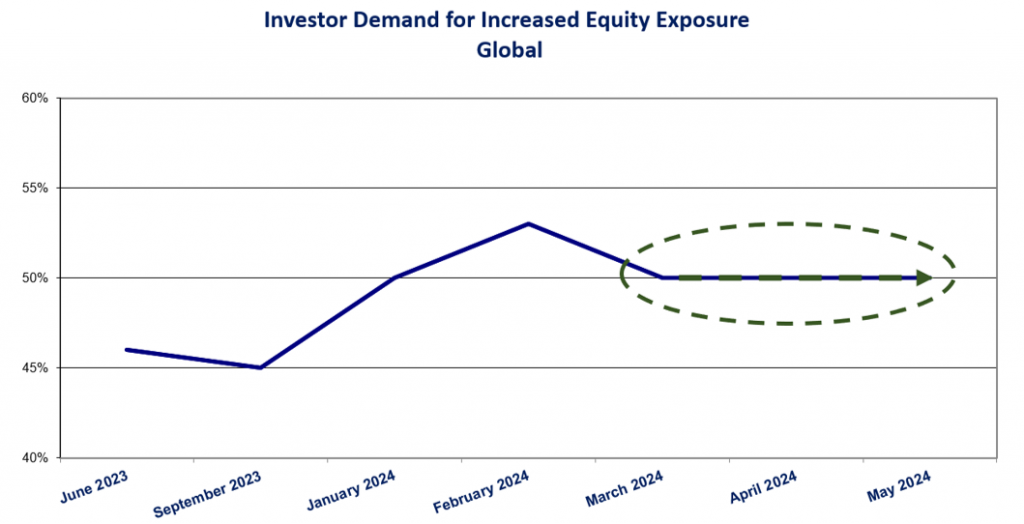

Worldwide Investor Poll – Demand For Equity Exposure Remains Level –

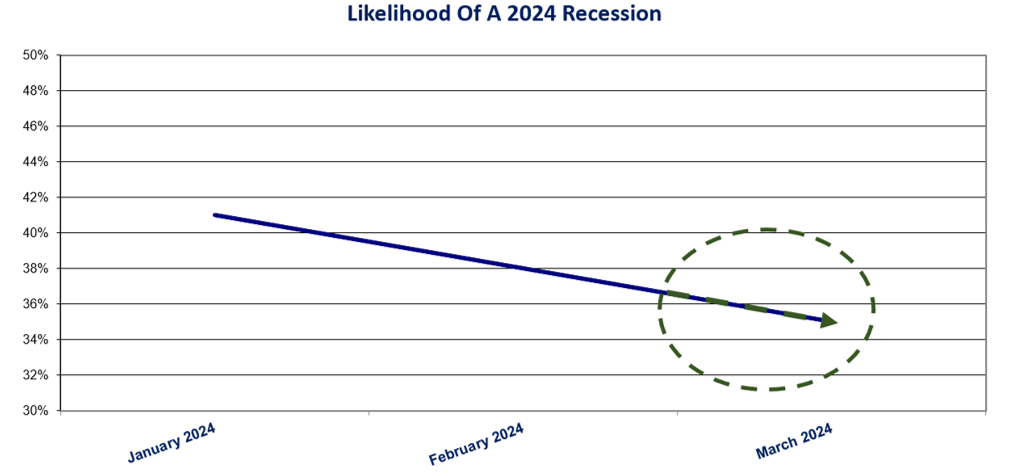

Less Investors Expect 2024 Recession

New York, NY, March 4th 2024

Are you planning to be a net buyer in the near term 3 months? (Net buyer means own more $ in equities than you do today.)

Yes = 50% (At February 21st 2024 – 50%)

No = 50% (At February 21st 2024 – 50%)

If you are not planning to be a net buyer, are you planning to be a net seller in the near term 3 months? (Net seller means own less $ in equities than you do today.)

March 4th 2024 = 38% (At February 21st 2024 – 40%)

Likelihood Of A 2024 Recession

March 4th 2024 = 35% (At February 21st 2024 – 38%)

Rising/falling demand for stocks is estimated through Brendan Wood’s daily personal debriefs with big cap investors. Approximately 2000 yearly discussions with managers overseeing +/-$60 trillion, estimate quality and demand, stock by stock, across 1400 large cap investment targets. The aggregated findings aim to broadly anticipate the forthcoming net increasing or decreasing demand.

TopGun Names:

Microsoft Corp.

Mastercard Inc.

Progressive Corp

Visa Inc.

CrowdStrike Holdings Inc

Alphabet Inc

UnitedHealth Group Inc.

ASML Holdings NV

Nvidia Corporation

Danaher Corp.

If you would like to subscribe please send an email to

jnovak@brendanwood.com or aknott@brendanwood.com or gpeck@brendanwood.com

Prior Releases:

About Brendan Wood International:

Brendan Wood International (BWI), formed in 1970, is a private advisory group which originates performance investigation programs in the capital markets. Brendan Wood Partners debrief large institutional investors worldwide on a daily basis. There are 2000+ live consultations with professionals overseeing +/- $60 trillion invested in the +/- 1400 big cap companies on the BWI Index. Relying on its real time performance intelligence, BWI advises public companies, institutional and activist investors, investment banks and broker dealers on strategy, performance and recruitment of TopGun talent. The firm’s partners have formally presented at 1000+ C level strategy meetings and corporate off-sites in fifty cities. Brendan Wood founded the exclusive TopGun Club, a performance based institution. Brendan Wood International is the research provider and sub-advisor to the Brendan Wood TopGun ETF (Ticker: BWTG)

Disclaimer:

All reports, evaluations and assessments contained herein, represent Brendan Wood International’s subjective judgment and opinions, based on our years of experience and on information obtained by us in the course of our research. Much of the factual information contained in the reports has been obtained by us from third parties on whose responses we have relied in good faith, independent verification by Brendan Wood International being, under the circumstances, impossible. While we believe that you will find our reports to be an invaluable tool in formulating your own strategies and judgments, the foregoing should be borne in mind. This report is not meant as investment advice and should not be interpreted as advising on the value of a company’s securities, the advisability of investing in, purchasing or selling any company’s securities or any other conclusion relating to investment/divestiture of a company’s securities. Finally, this report is not intended as an offer or solicitation for the purchase or sale of any company’s securities.

Contacts:

Jordan Novak

Managing Partner

Brendan Wood International

+1 416 924 8110

jnovak@brendanwood.com

Amanda Knott

Managing Director

Brendan Wood International

+1 416 924 8110

aknott@brendanwood.com

Posted in Press Releases

|

You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.